By Ryan Davis

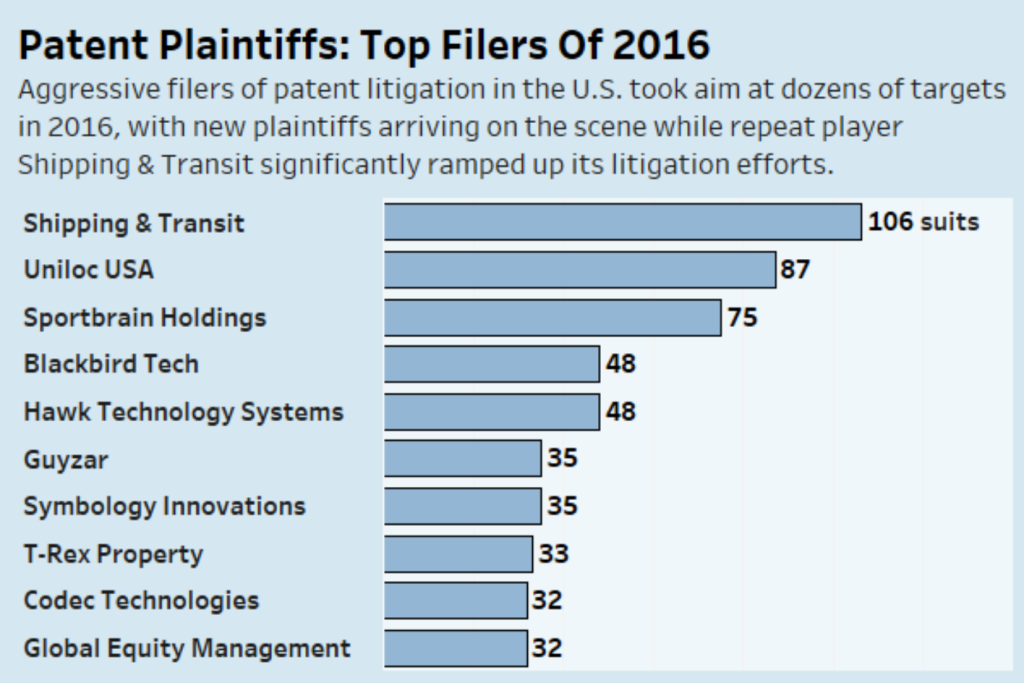

Law360, New York (March 1, 2017, 12:13 PM EST) The companies that filed the most patent lawsuits in 2016 include familiar names long known for their litigation campaigns as well as relative newcomers that recently ramped up enforcement efforts, including one founded by former BigLaw partners.

Shipping & Transit LLC

With 106 new lawsuits filed in 2016, according to statistics compiled by Law360, Shipping & Transit took the top spot on the list of the year’s most active patent plaintiffs, and it is no stranger to such recognition. The 65 suits the company filed in 2015 put it in fourth place on last year’s list, and its predecessor, ArrivalStar SA, came in first in 2013 with 131 suits.

Shipping & Transit owns several patents on technology for tracking vehicles and deliveries, which it asserts against companies large and small that sell products online and allow customers to track orders.

“They have sued more than anyone else and sometimes gone after momandpop operations,” said Shawn Ambwani, chief operating officer of Unified Patents, which has challenged one of Shipping & Transit’s patents in an inter partes review. “They’re saying if you track a shipment on your website, you’re infringing. There could be thousands of companies that do that.”

Last year’s wave of Shipping & Transit suits, filed mostly in the Central District of California and the Southern District of Florida, targeted big names like Greyhound Lines Inc. and Comcast Corp., as well as smaller online merchants like Neptune Cigars Inc. and DiscountRamps.com.

Shipping & Transit was formed in 2015 when it acquired the patent portfolio of ArrivalStar, which had already made a name for itself as a prolific patent plaintiff, targeting retailers, shipping companies and public transit agencies. The company claims that its patents grew out of an invention its co founder developed in the 1980s to notify parents of arriving school buses.

A representative of the company could not be reached for comment for this story. Company officials told The Wall Street Journal in October that Shipping & Transit and ArrivalStar have collected licensing fees from over 800 companies, amounting to over $15 million.

Unified Patents, which describes itself as “the antitroll” and files inter partes reviews seeking to invalidate what it calls bad patents asserted against companies that pay membership fees, persuaded the Patent Trial and Appeal Board this month to institute a review of one of Shipping & Transit’s patents.

Unified Patents’ Ambwani said that companies like Shipping & Transit are “really going underneath the IPR envelope” and offering to license patents for less than the many thousands of dollars it would cost any one small company to mount an inter partes review challenge.

“They’re often sue, quickly settle and move on, and make it reasonable enough that almost everyone settles,” he said.

Uniloc USA Inc.

Uniloc USA took second place on the list, racking up 87 new patent lawsuits in 2016, a busy year for a company that has long been known as an active patent plaintiff. In 2014, it came in ninth place on the list with 44 suits.

Shipping & Transit and other prolific plaintiffs are often narrowly focused on asserting patents covering certain technologies, but Uniloc, which filed all of its suits in the Eastern District of Texas, wields a wide variety of patents spanning several industries.

In 2016, it accused companies of infringing its patents on technology for messaging apps, video streaming and organizing medical data. Its targets included power players of several stripes, including Facebook Inc., Apple Inc., HealthSouth Corp. and CVS Pharmacy Inc.

“Shipping & Transit and [thirdmost active plaintiff] Sportbrain basically license one campaign, but Uniloc has multiple ones against different types of companies,” said Ambwani, whose company unsuccessfully challenged one of Uniloc’s patents at the PTAB last year.

Sega of America Inc. had better luck, though, and persuaded the PTAB to invalidate a Uniloc patent on software registration technology in a final inter partes review decision in March. That patent has been at the center of scores of Uniloc patent suits for many years, including a $388 million jury verdict in 2009 against Microsoft Corp.

The Federal Circuit later ordered a new trial on damages and the companies settled. Uniloc then continued to assert the patent against many other companies, including Sega, prompting the video game maker to target it at the PTAB.

Sportbrain Holdings LLC

After filing a small handful of patent suits in previous years, Sportbrain ramped up its enforcement efforts in 2016, filing a total of 75 new lawsuits in the Northern District of Illinois over a single patent for technology to collect personal health data, like heart rate and the number of steps a person takes.

Its targets have included numerous makers of wearable devices, including Apple Inc., whose Apple Watch is accused of infringing, along with Garmin International Inc. and Fitbit Inc., and watchmakers like Timex Group USA Inc. and Tag Heuer USA Inc.

Sportbrain marketed a “personal fitness assistant” and a pedometer in the 2000s, but they were unsuccessful. The company shifted its business strategy to enforcing its patent in early 2016.

Sportbrain’s founder, Harry Heslop, told Law360 in January 2016 that the company was the first to market what has now become the burgeoning field of wearable activity trackers, and that to be “squeezed out by a plethora of Goliaths was unquestionably devastating.”

“As the ‘David’ in this story, we will slingshot our IP at all the offenders and unleash the full extent of the law until justice is served,” he said. Heslop could not be reached for further comment for the story.

In what is now a familiar story for prolific patent plaintiffs, the PTAB is also taking a close look at the patent at the heart of Sportbrain’s litigation campaign. On Feb. 10, the board instituted an inter partes review of the patent, again at the request of Unified Patents.

Ambwani noted that Sportbrain has sued a wide range of companies that make varied products to keep track of biological data.

“Whenever you have a broad claim that is asserted against so many companies, it lends itself to be successfully challenged at the PTAB because they tend to be lowquality,” he said.

Blackbird Technologies

Formed by former WilmerHale and Kirkland & Ellis LLP partners, Blackbird Technologies is a newer entrant on the list of top patent plaintiffs, coming in at fourth place with 48 suits last year in the District of Delaware spanning a wide range of technologies.

Blackbird, which was founded 2 1/2 years ago and filed a smaller number of suits in 2014 and 2015, says that its goal is to level the playing field in patent litigation and help individual inventors and small companies to make money from their patents.

President and CEO Wendy Verlander, formerly a partner at WilmerHale, said in an interview Friday that she and her colleagues came to recognize the imbalance in the patent system while representing large companies at major law firms.

“We really saw that big companies have all the advantages in making money from their inventions, and that small inventors really struggle,” she said.

They created Blackbird with a goal of using inhouse expertise rather than expensive law firms to litigate patent cases for smaller players more efficiently. The company now has several attorneys who have previously worked at firms including Kirkland, Fish & Richardson PC and White & Case LLP.

In 2016, the company filed suits against Netflix Inc., Home Depot USA Inc., Uber Technologies Inc., Fitbit Inc., Lululemon Athletica Inc. and more. The suits involve patents in a wide array of technologies, including digital video, LED lighting, exercise monitoring and sports bras.

Verlander said the company has purposely sought out a diverse portfolio, with an eye toward bringing cases based on strong patents rather than on a specific kind of technology. Many of the inventors the company works with have tried avenues including manufacturing products and licensing, but have “hit a brick wall” and turn to Blackbird to enforce their patents, she said.

“Unlike some [nonpracticing entities], we’re ready to litigate cases,” she said. “We only bring cases that we believe are meritorious, and we don’t file anything unless we feel it can go the distance.”

The narrative that portrays nonpracticing entities as bad actors is unfair, she said, because it paints everyone with a broad brush rather than looking at how each company operates. The attorneys at Blackbird analyze patents and prepare for cases at the new company the same way they did when they worked at top law firms, she said.

“We’re not in it to settle cases quickly,” she said. “We’re looking to litigate cases and get the right value for patents for inventors and small businesses and also for us.”

–Editing by Katherine Rautenberg and Mark Lebetkin.